Coinbase just announced the launching of the first fully regulated Bitcoin exchange in the United States and the cryptocurrency community, along with every medie outlet, is making the good news go viral.

The company – which scored a record funding round of $75 million just last week thanks to the investments of major institutions and personalities from the financial world – told The Wall Street Journal that it now has “regulatory approval” in half of all US states, including significant regions such as New York and California.

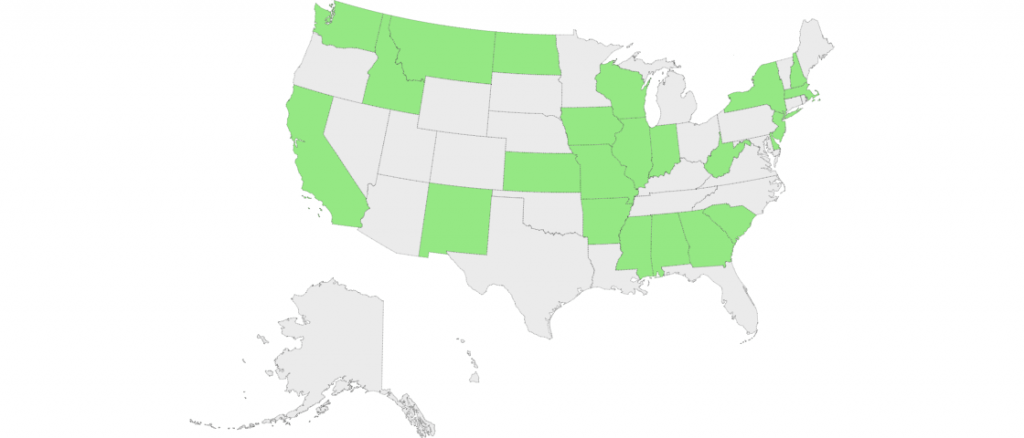

Coinbase Exchange is already fully operating in 24 US states and territories.

Alabama (AL)

Alabama (AL)- Arkansas (AR)

- California (CA)

- Delaware (DE)

- Georgia (GA)

- Idaho (ID)

- Illinois (IL)

- Indiana (IN)

- Iowa (IA)

- Kansas (KS)

- Massachusetts (MA)

- Mississippi (MS)

- Missouri (MO)

- Montana (MT)

- New Hampshire (NH)

- New Jersey (NJ)

- New Mexico (NM)

- New York (NY)

- North Dakota (ND)

- Puerto Rico (PR)

- South Carolina (SC)

- Washington (WA)

- West Virginia (WV)

- Wisconsin (WI)

Coinbase’s goal is to “bring increased stability to the Bitcoin ecosystem”. According to the company, the new platform will provide “a reliable and secure platform for Bitcoin trading that is backed by investors such as the New York Stock Exchange”.

If you’re a Bitcoiner in one of the 24 territories where the exchange is currently operating, you can start trading immediately without paying any fees until March 30th. After that, the exchange will adopt a maker-taker model.

Orders which provide liquidity are charged different fees from orders taking liquidity. The fee is assessed as a percentage of the match amount (price * size).

Taker – 0.25% fee

Maker – 0.0% feeFees are assessed at the time of match. An order can be both a maker and a taker if part of the order is immediately filled and another part is put on the order book and filled later. Each fill will be assessed fees independent of other fills.

“We believe Coinbase Exchange will bring stability and trust to the exchange space and are excited that large institutions like the Trading Division of SecondMarket are already trading on the platform”, Coinbase added.

Image source: Coinbase

6 Comments

6 Comments